EDB’s guideline for exporters

REGISTRATION AS AN EXPORTER

A person who intends exporting any articles of commercial value form Sri Lanka is required to register with following institutions.

- Sri Lanka Export Development Board (EDB Reg. Number) (http://www.srilankabusiness.com/)

- Inland Revenue Department (Tax Identification Number / Vat Number) (http://www.ird.gov.lk/en/sitepages/default.aspx)

iii. Sri Lanka Customs (http://www.customs.gov.lk)

To register with the above institutions, the exporter is required to produce the original Business Registration Certificate or certificate of Incorporation and other related documents along with duly completed application forms. Application forms are available at the above institutions.

PRODUCTS THAT REQUIRE REGISTRATION / LICENSE / CERTIFICATES FOR EXPORT

2.1 COMMODITY WISE REGISTRATION

The exporters of following commodities should be registered with authorities concerned annually.

- a) Tea

Tea Exporters are required to register with the Sri Lanka Tea Board. For this purpose, they have to fulfill the following requirements:

Adequate organization (Business Registration Certificate or Certificate of incorporation)

Sufficient Financial Recourses

(At least 01 million Working capital – A reference letter from the bank should be submitted)

Adequate Warehousing Facilities for storing of Tea

Duly Completed application form. Application forms are available at the Tea Export Division of the Sri Lanka Tea Board.

The registration fees are as follows.

Registration Fee Rs.: 58,650- (All Inclusive)

Tea Packers Registration Fee Rs.: 58,650- (All Inclusive)

Warehouse Registration Fee Rs.: 25,000- (VAT+NBT)

The registration should be renewed annually. Renewal charges have to be paid.

For more details, please contact Sri Lanka Tea Board, No: 574, Galle Road, Colombo 03.

Website: http://www.pureceylontea.com/

b) Coconut & Coconut Products

The exporters of coconut products should be registered with the Coconut Development Authority (CDA) annually. The Registration fees are as follows:

Kernel Product

(Copra, Desiccated Coconuts, Coconut Oil, Coconut Milk etc.) : Rs. 10,000

Coconut Shell Product : Rs. 10,000

Coconut Fiber Product (VAT & NBT Applicable) : Rs. 10,000

For more details, please contact Coconut Development Authority, Marketing Division, Nawala Road, Narahenpita.

Website: http: //www.cda.lk/web/index.php?lang=en

- c) Gems & Jewellery

The exporters of Gem & Jewellery should obtain a Gem Dealers License from National Gem & Jewelry Authority (NGJA). This License could be obtained for varying amounts depending on the maximum stock the exporter will hold at any given time.

More details: National Gem & Jewelry Authority, No: 25, Galle Face Terrace, Colombo-3.

Website: http://www.ngja.gov.lk/en/

- d) Textile & Readymade Garments

All Exporters of garments should be registered with the Apparel Export Service Division of the Ministry of Industry & Commerce. All enterprises registered under BOI law should be registered with the BOI.

Website: Ministry of Industry & Commerce – http://www.industry.gov.lk/ BOI – http://www.investsrilanka.com/

3. ITEMS UNDER LICENSE CONTROL

Following items are subject to export license issued by the controller of import and exports.

Guidelines on Export Control Licensing Procedure for Exportation of Export Controlled Commodities.

(http://www.imexport.gov.lk/web/images/PDF_upload/Guidelines/export.pdf

4. ITEMS PROHIBITED OR RESTRICTED FOR EXPORTS

I. Dead or live animal or its parts. Permits are issued for research purposes and for exchange with foreign zoos and museums.

II. Antiques/ Cultural Property

III. Dangerous drugs

IV. Explosives

V. Live Fish(Prohibited species)

VI. Mineral- raw form

VII. Obscene publication and literature

VIII. Protected plants listed under the Fauna & Flora Protection Ordinance

5. SALES CONTRACTS

There should be a sales contract between the seller (Exporter) and the buyer (Importer). The seller (Exporter) should prepare a pro-forma invoice and send it to the buyer. The pro-forma invoice is an invitation to the buyer to place a firm order and it often requires the importer to make his import arrangements. In the pro-forma invoice following details should be mentioned.

Product description

Quantity

Price

Terms of payments (L/C, D/P, D/A etc.)

Terms of Delivery (FOB, CFR, CIF etc..)

Packing & Marking details

5.1 Delivery Terms

Delivery Terms such as FOB, CFR, CIF which are internationally standardized and inform the buyer & seller what is included in the sales price regarding the transport cost, (freight charges) transfer of risk insurance and customs clearance.

- Free On Board– (FOB) (…..named port of shipment)

Free on board means that the seller must load the goods on board the ship nominated by the buyer, cost & risk being divided at the ship rail. This means the buyer has to bear all costs and risks of loss of or damage to the goods from that point. Under this term the seller must clear the goods for export. This term can be used for maritime transport.

- Cost & Freight– (CNF/CFR)(….named port of destination)

Cost & freight means that the seller pays the cost and freight to bring the goods to the port of destination. The seller must clear the goods for export. However, risk is transfer to the buyer once the goods have crossed the ship rail. This term can be used for maritime transport only.

III. Cost Insurance and Freight– (CIF)(…..named port of destination)

Under this term, the seller must pay the cost and freight to bring the goods to the named port of destination in addition, the seller must procure marine insurance against the buyer’s risk of loss of or damage to the goods during the carriage. Under this term the seller has to clear the goods for export. This term also can be used only for maritime transport.

TERMS OF PAYMENT

The terms of payment agreed between the exporter and the importer depends on how well the exporter and the importer, risk involved in the transaction, and the volume of business. Methods of payment for foreign trade are;

- a) Advance payment

- b) Letters of Credit (LC)

- c) Documentary Collection

- Documents against Payment (DP)

- Documents against acceptance (DA)

- d) Open Accounts

- e) Consignment account

- a) Advance Payment

The most favored payment method for the export is advance payment in this method of payment the buyer remits money to the seller (exporter) before the goods are shipped, generally with the order.

2 b) Letters of Credit (LC)

A letter of credit is a written undertaking given by a bank (issuing bank) to the seller (beneficiary) at the request and in accordance with the instructions of the buyer (applicant of the credit to make payment up to a stated sum of money within a prescribed time limit against stipulated documents, Complying with all terms and condition of the credit.

This is the most acceptable to the both the buyer and the seller.

3. c) Documentary Collection

The seller used the services of a bank in his country (Remitting Bank). Then the remitting bank will get the service of a bank in the buyer’s country (Collecting bank) to collect the payment from the buyer. If everything goes smoothly with the buyer’s bank (collecting bank) will collect the payment and remit same to the seller’s bank.

The documentary collection could be categorized under two headings:

4 Documents Against Payment (DP Terms) Sight Bill

After the shipment, documents are delivered to the buyer’s bank (collecting bank) with clear instructions through the seller’s bank (remitting bank) According to the instructions given by the remitting bank. The buyer’s bank (collecting bank) releases all shipping documents to the buyer only after payment. Then the buyer’s bank remit money to the seller’s bank and seller’s bank gives same to seller (exporter)

5 Documents Against Acceptance (DA Terms) Term Bill

All shipping documents along with a bill of exchange (term bill) are delivered to the buyer’s bank with clear instructions through the seller’s bank. According to the instructions given by the sellers bank the buyer’s bank releases documents to the buyer only after acceptance of term bill and the payment is obtained on the due date.

6 d) Open Accounts

An arrangement between the seller and the buyer in order to settle buyer’s debt at a pre-determined, future date i.e. at the end of the month or one month after each shipment. Under this method both goods and documents are sent directly to the buyer in advance.

e) Consignment Accounts

This method is somewhat similar to the open Account system. Goods and documents are sent direct to the buyer. The buyer remits to money to the seller with the sales account agreed intervals or on completing of the sale

- SENDING TRADE SAMPLES

The foreign buyer may ask for samples of products before a trade transaction takes place. In such a case the exporter will send samples of his products to the foreign buyer, and the samples are usually sent by air mail to avoid undue delays.

The trade samples up to the value of Rs: 50,000 can be exported freely and only a customs declarations form (CUSDEC 1/11) needs to be furnished. The number of units of trade samples that can be exported will be determined by the Director General of Customs. However, the samples of Gems & Jewelry are not permitted to send as a sample.

- PACKAGING

Packaging is an important aspect contributing to the positioning of a product in the market. Packaging must protect the product on its way from the exporter to the ultimate consumer.

The exporter should ensure that;

- The packages are properly packed to resist rough handling in the transportation by sea/air.

- The packaging has been done according to the buyer’s requirements are specified in the trade contract.

- The shipping marks and the port if destination is marked on all packages

- The packages are loaded in such a way to facilitate inspection by customs officials.

Other Important Facts to be considered in Export Packaging

Rules in the export market – check that your consignments comply with market regulations. Certain markings may be required and in some countries certain packaging materials are not allowed

Restrictions on wood packaging – The International Plant Protection Convention (IPPC) mandate that wood packaging used in international trade must be treated to guard against the distribution of unwanted pests. The treatment methods could be either heat treatment or fumigation with methyl bromide. The IPPC Secretariat has issued ISPM 15 (International Standards for Phytosanitary Measures) “Guidelines for Regulating Wood Packaging Material in International Trade”. In many cases it will be sufficient to check that your wood packaging is ISPM 15 compliant.

Packaging waste – The need for any packaging should be evaluated in the research, design and marketing stages of a product. The goal should always be to reduce unnecessary packaging. Where the need for packaging exists, packaging should follow the 3R’s hierarchy namely Reduce, Reuse and Recycle. In many export markets, there are stricter rules on packaging waste and collection, such as the “green dot system” in Germany.

Hazardous goods – any exports of dangerous goods will have to be safely packaged and clearly marked and labeled. The rules vary slightly depending on which mode of transport you’re using.

Insurance – your transport insurance cover may be adversely affected if it can be shown that your goods were damaged due to poor packaging.

Contracts – to avoid disputes in case goods are damaged in transit, consider including packaging specifications in your contracts with buyers.

- RESERVATION OF CARGO SPACE

a) Sea Cargo

Shipping space should be reserved well ahead of the date of shipment. Therefore, the exporter should meet the shipping agent to get reserved shipping spaces. For this purpose, exporter should submit duly completed shipping note (EXP. 3a forms – 03 copies) to the shipping agent.

Further details: http://www.slpa.lk/EDI_services.asp?chk=3#

- b) Air Cargo

Commodity Cut-off Time

General Cargo 12 hours – STD

Perishable/GOH/VAL Cargo 06 hours – STD

Tuna Fish/Live Fish/Edible Fish 05 hours – STD

Samples – Shipment up to 50Kg 04 hours – STD

Courier Materials / Newspaper 03 hours – STD

Live Animals / Diplomatic Mail 02 hours – STD

/ Human Remain(HUM) &

Live Human Organs(LHO)

For air cargo the exporter would have to check with the “Air Line Agents” offices servicing the country concerned. The exporter should submit a document called shippers instructions for dispatch. Finally this document will be used to issue the Airway Bill (AWB)

The cargo should be brought to the airport prior to the arrival time for the aircraft. This is called “cut off time”.

STD – Standard Time for Departure

CERTIFICATE REQUIRED FOR EXPORTS

a) Certificate of Origin (GSP Certificate)

This certificate is required by the customs of the importing country. It is issued by Department of Commerce. The Department of Commerce responsible for issuing COO under all GSP schemes, Free Trade Agreements and Multi-lateral Trading Agreements.

Further Details: http://www.doc.gov.lk

- b) Certificate of Origin

This is also required by the customs of the importing country. It is issued by chambers, i.e; Ceylon Chamber of Commerce or National Chamber Commerce.

- c) Quality Certificate

This is issued by Sri Lanka Standard Institution.(SLSI). Private quality certificates are issued by SGS Lanka (Pvt) Ltd.

- d) Health Certificate

Health certificate may be required by the Health Authorities of the importing country, when meat, fish and live animal are being exported. It is issued by the Department of animal Production & Health. With regard to food items, health certificates are issued by the Food Control Administrative Division of the Ministry of Health.

- e) Phytosanitary Certificate

This certificate is required by the importing country, when exporting cut flowers and foliage plants, fruits and vegetables etc. It is issued by the Plant Quarantine Service of the Department of Agriculture.

- f) Fumigation Certificate

This certificate may be required by buyers/government for the import of Agricultural Products such as cut flowers foliage plants, sesame seeds, Cashew nuts, tea etc. Fumigation activities are done by plant quarantine service of the Department of Agriculture. Some private companies approved by the Department do these activities.

- CUSTOMS PROCEDURES

a) Making Customs Declaration

- Customs Declaration (CUSDEC)

In international trade commodities cross borders of countries. At the border, the parties involved in the trading transaction are required to declare to the relevant authority at the border, the details of the commodities that are being imported or exported. The declarations made at the border point, which can be a sea port or airport or land point is named as the Good Declaration. In Sri Lanka, the Good declaration is known as the CUSDEC and the Customs Ordinance, section 47 for imports and section 57 for exports, every imports/exports stipulates that a declaration has to be made to the Customs in order to effect on imports or exports. The details declared in the CUSDEC are vital because the details contain are venue implication and statistical implication. Therefore, the CUSDEC has to be filled in with utmost vigilance.

For CUSDEC guidelines refer: http://www.customs.gov.lk/cusdec.html

- Commercial Invoice

Invoice is a document prepared by the Exporter stating all the particulars regarding the shipment. This has to be filled along with the Goods Declaration at the time of processing it at the Export Office. Document required by customs in an importing country in which the seller states the price (e.g. selling price) and specifies costs for freight, insurance and packing, etc., terms of delivery and payment. This is for the purpose of determining the customs value in the importing country of goods consigned to that country.

Packing List

A document specifies the contents of each individual package in the shipment.

Other Documents (if applicable)

Any Permits / License

Tea Blend Sheets

Material Utilization Sheets

Direct Trader Input (DTI)

Direct Trader Input gives an exporter or his agent (declarant) the capability to complete the full Customs process or formalities remotely – from that Declarant’s office.

Please follow the following link for DTI registration: http://www.customs.gov.lk/dtiregi.html

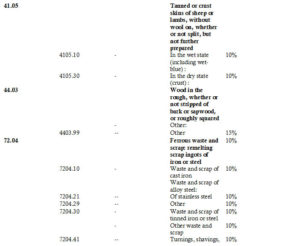

- b) Export Duty & Cess Charges

At present, exporters are not required to pay customs duty. Even though, when exporting traditional products (tea, rubber, coconuts etc.) export Cess must be paid to the customs. CESS Charges on Exports

Source: Gazette Notification No. 1941/32 dated 20.11.2015

11. CUSTOMS PROCEDURES

a) Making Customs Declaration

- Customs Declaration (CUSDEC)

In international trade commodities cross borders of countries. At the border, the parties involved in the trading transaction are required to declare to the relevant authority at the border, the details of the commodities that are being imported or exported. The declarations made at the border point, which can be a sea port or airport or land point is named as the Good Declaration. In Sri Lanka, the Good declaration is known as the CUSDEC and the Customs Ordinance, section 47 for imports and section 57 for exports, every imports/exports stipulates that a declaration has to be made to the Customs in order to effect on imports or exports. The details declared in the CUSDEC are vital because the details contain are venue implication and statistical implication. Therefore, the CUSDEC has to be filled in with utmost vigilance.

For CUSDEC guidelines refer: http://www.customs.gov.lk/cusdec.html

- Commercial Invoice

Invoice is a document prepared by the Exporter stating all the particulars regarding the shipment. This has to be filled along with the Goods Declaration at the time of processing it at the Export Office. Document required by customs in an importing country in which the seller states the price (e.g. selling price) and specifies costs for freight, insurance and packing, etc., terms of delivery and payment. This is for the purpose of determining the customs value in the importing country of goods consigned to that country.

Packing List

A document specifies the contents of each individual package in the shipment.

Other Documents (if applicable)

Any Permits / License

Tea Blend Sheets

Material Utilization Sheets

Direct Trader Input (DTI)

Direct Trader Input gives an exporter or his agent (declarant) the capability to complete the full Customs process or formalities remotely – from that Declarant’s office.

Please follow the following link for DTI registration: http://www.customs.gov.lk/dtiregi.html

- PORT PROCEDURES

- a) Port Charges

Before transporting goods to the port, the exporter has to pay port charges to the Finance Division of the Sri Lanka Ports Authority (SLPA). To pay these charges, he is expected to submit completed 03 copies of shipping Note – (EXP 3a) to this division. Once charges are paid the Finance Manager retains 01 copy and gives 02 copies to the exporter. This is called

charges paid copies of Shipping Note. These charges are applicable to all ports, serviced by the SLPA when dealing with import & Export transaction.

These charges could be categorized under following headings:

- Landing & Delivery Charges

- Shipping Charges

- Bonding & Entrepot Charges

- Crane charges

- Occupation Charges (Rent)

- Ancillary Charges for services, if required

- b) Moving Cargo to the Port

When delivering cargo to the port, following documents should be prepared and submitted to Export Office of the SLPA/JCT Export Office

- i) Shipping Note (Exp. 3a form)

05 copies should be submitted

- ii) Cargo Dispatch Note (Exp. 3b form) (CDN form)

06 copies should be submitted

In addition to the above, shipping Note (SLPA charges copy) and CUSDEC from (Security Copy) must also be attached.

After registration and monitoring of the cargo/container, at the Export Office of Sri Lanka Ports Authority (SLPA), the exporter is required to take the cargo to the jetty.

Once all the cargo/containers have been loaded, the shipping note is converted to the Mate’s receipt when the captain of the vessel signs it. The SLPA officer on board the vessel will send the mate’s receipt to the SLPA export office.

The exporter may collect his copy of the mates receipt from the SLPA export office and submit it to shipping Agent to obtain bill of lading (B/L). At this stage the exporter would be required to pay freight charges (where applicable) to the Shipping Agent.

- SUBMITTING THE DOCUMENTS TO THE COMMERCIAL BANK

Final stage of shipping is to submit documents to the bank. They are:

Commercial Invoice

Original Bill of Lading /A.W.B. No.

Insurance Policy (if on CIF)

Bill of Exchange (If on DP or DA terms)

Letter of Credit

Certificate of origin / GSP Certificate

Packaging List

The following documents should also be submitted on the request of the buyer;

Quality Certificate

Health Certificate

Phytosanitary Certificate

Fumigation Certificate

HACCP Certification (for food items)

Any other certificates/ Test reports such as Global GAP / GMP

- a) Exporting on letter of credit Terms (L/C terms)

If an L/C had been established for this shipment, all shipping documents must be submitted to the advising bank. (exporter’s bank). The exporter should ensure that all conditions stipulated in the L/C are fulfilled. The documents could be negotiated at this stage and the exporter may obtain his money for the shipment.

Copies of the above documents should be sent to the buyer as early as possible.

- b) Exporting on D/P Terms

After the goods are shipped a Bill of Exchange (Sight Bill) would be sent along with the shipping documents to the buyer’s bank for payment by the importer (buyer) if the contract is based on Documents Against Payment (D/P term)

- c) Exporting on D/A Terms

A bill of exchange (Terms Bill) would be sent along with the Shipping documents to the Buyer’s bank for acceptance by the importer (buyer) if the contract is based on documents against acceptance (D/A Terms)